Property bubbles seem like strange things: if everyone wants to buy and build better property, why should this cause the prices and investments to crash? Using a simple demand and supply framework, we can explain one way that this can happen.

Property bubbles seem like strange things: if everyone wants to buy and build better property, why should this cause the prices and investments to crash? Using a simple demand and supply framework, we can explain one way that this can happen.

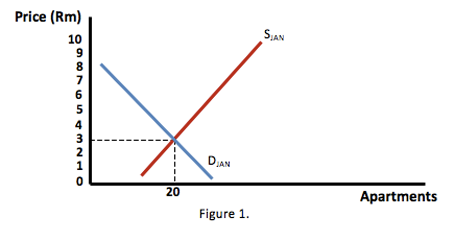

All prices in a free market are set by the interaction of demand and supply. Demand and supply curves are on the axes of price and quantity. The demand curve is a downward-sloping curve that shows how much is demanded at every level of price. The supply curve is an upward-sloping curve that shows how much is supplied at every level of price. Only when these two curve cross – at a price where the amount demanded is equal to the amount supplied – is the market in equilibrium and the price set. The diagram below shows a market where the demand and supply of apartments in Sea Point during January is at equilibrium, where 20 apartments are demanded and supplied at a price of R3 million each.

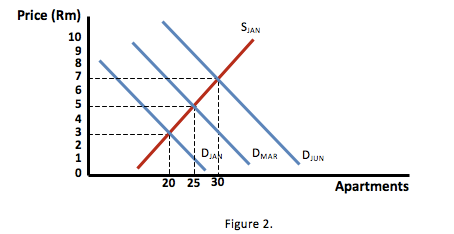

Imagine that between January and March, national income increases and more people can afford to buy apartments. This will have the effect of increasing demand and the entire demand curve will shift to the right to DMAR. Because no more apartments have been built, the increase in demand has caused the price to go up to R5 million. At this new price, suppliers of apartments have a greater incentive to put their apartments on the market and the supply increases to 25 apartments. Note that there is a difference between more existing apartments entering the market and new apartments being built. The amount of existing apartments on the market will increase to match the price and decrease when price decreases; this is shown as a new point on the existing supply curve. Building new apartments means that there is greater supply at every price, and therefore the curve will shift.

Imagine that between January and March, national income increases and more people can afford to buy apartments. This will have the effect of increasing demand and the entire demand curve will shift to the right to DMAR. Because no more apartments have been built, the increase in demand has caused the price to go up to R5 million. At this new price, suppliers of apartments have a greater incentive to put their apartments on the market and the supply increases to 25 apartments. Note that there is a difference between more existing apartments entering the market and new apartments being built. The amount of existing apartments on the market will increase to match the price and decrease when price decreases; this is shown as a new point on the existing supply curve. Building new apartments means that there is greater supply at every price, and therefore the curve will shift.

Property investors see that the price of apartments has nearly doubled in two months and they think to themselves that if they get in now, they can surely make a killing. The demand for Sea Point apartments therefore increases again as investors buy. By June, it has shifted out to DJUN and established a new price in the market of R7 million at a supply of 30 apartments.

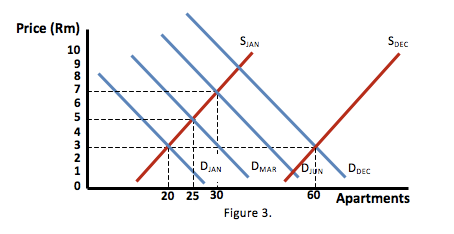

Property developers are watching this and thinking that they need to get in on the action. If prices have risen so much, surely building a few more apartment blocks will mean they make a lot of money? They start building in June and plan to complete the apartments by December. In the mean time, demand has continued to increase and, by December, it has increased to DDEC. If the number of apartments built remained at January levels, then the price would go up to about R9 million. But because all the construction is completed in December, supply jumps out to SDEC Everyone was building apartments to capitalise on the property boom, but this increase in supply has created a new equilibrium, right back down at R3 million (Figure 3). Developers were increasing supply to match demand but, because many developers were doing, this supply overshot demand. When supply is higher than demand, prices come down. In this case, the number of new apartments was enough to increase the supply and drop the price back down to its lowest level, rendering the investments pointless.

As developers see that the price is coming down, they either sell their developments quickly to try and recoup losses, or they hold onto them hoping that demand will pick up again in the future and they will one day be able to get the returns that they were hoping for.

This poor foresight is one reason why the market can crash. Another is that developers increase supply by a modest amount and incomes drop unexpectedly, shrinking demand and forcing developers to drop the prices of their apartments and make less profit, or even losses, depending on how much they invested.

The smart property developer and investor needs to understand that if they have seen a good investment opportunity, then the chances are that others have too. They need to engage in investments that take into account the possible actions of others and not just assume that the market will stay as it currently is.

Article reference: Paddocks Press: Volume 6, Issue 2, Page 2

Recent Posts

Archives

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- March 2009

- February 2009

- February 2008

- February 2007

Recent Comments