Have trustees always had the right to call for a special levy?

The provisions empowering the trustees of sectional title schemes to raise a special levy have come and gone from the Sectional Titles Act and the prescribed rules.

Recently we were asked whether, because of those comings and goings, there had ever been a period during which the special levy provisions were completely absent, a gap in the trustees’ power to raise a special levy. Obviously the person asking the question was hoping the special levy he had had to pay was invalid and he was entitled to withhold his levy payments until the amount had been made up!

The Act does not actually refer to levies, it refers to contributions, and in section 37(1)(b) says the body corporate must require the owners to make contributions to the administrative fund, and later in the same section, to raise the amounts required to fill up the fund by levying contributions on the owners. Hence the term, “levies”.

The history:

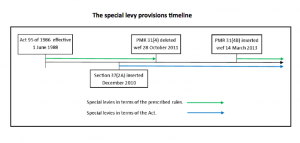

Originally, there was no provision in the Act for special contributions, the provision was contained in prescribed management rule 31(4). PMR 31(4) gave the trustees the discretion to raise special levies but only under two conditions. Paying the expense had to be a matter of necessity and the expense could not be paying any item contained in the budget approved at the AGM for that year.

Then, in October 2011, PMR 31(4) was deleted, in error it seems, but did that mean that the trustees were then not entitled to raise a special levy? No, because in the meantime, in December 2010, sections 37(2A) and (2B) were inserted into the Act.

Section 37(2A) makes three provisions: First, it gives the trustees the discretion to raise a special levy; secondly, it provides a method to recover any arrears; and thirdly, it makes the persons who are the registered owners on the date the trustees take the resolution liable for the whole of the amount. This is unlike section 37(2), which provides for the pro-rata payment of the levy by a new owner from the date of transfer of the unit into his or her name.

Section 37(2B) is just a definition of a special contribution, really. It makes the point that a special contribution is a different contribution to the one based on the approved budget. So, the annual levy and a special levy are not the same levy.

The PMR 31(4) provision, which was deleted in 2011, reappeared in March 2013 in exactly the same words as PMR 31(4B). Significantly, the conditions of ‘necessity’ and ‘unbudgeted for’ are therefore back in place; they are not included in section 37(2B).

The answer:

A glance at the diagram below gives a quick answer to the question that prompted this article. The trustees have and always have had the power to give the owners in their scheme a very nasty shock indeed!

Article reference: Paddocks Press: Volume 10, Issue 4, Page 2.

Anton Kelly is an extremely knowledgeable specialist Sectional Title and HOA teacher and consultant. Having been the lead teacher on all the Paddocks courses for the last 5 years, Anton lives and breathes Sectional Title and HOA law, all day every day. There are not many issues he hasn’t come across before.

This article is published under the Creative Commons Attribution license.

Recent Posts

Recent Comments

- Graham Paddock on Body Corporate Functions: Insurance

- Graham Paddock on Spending body corporate funds

- Graham Paddock on The Levy Clearance Certificate: The Body Corporate’s Cheap & Effective Weapon

- Graham Paddock on The benefits of online sectional title meetings

- Heinz Wiesner on The benefits of online sectional title meetings

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- March 2009

- February 2009

- February 2008

- February 2007

13 Comments.

I have just submitted a claim for water damage the claim was paid out to the body corporate and not to me directly why is this so?? Is it legal? And have been told any monies not use from the claim goes into the body corporate kitty?? I believe that I pay the insurrance for my property and I should be the one receving the money from the insurrance company

Hi Simon,

Thanks for your question. The body corporate is paid the claim money because it is the insured party, although each owner pays their PQ share of the premium. The body corporate should then pass the claim money on to the owner concerned. The owner is responsible to pay any excess on the claim, so if there is an excess, the pay-out will be less than the cost of the repairs. Therefore, there should not be any amount that will go into the body corporate kitty.

Thanks,

Paddocks

Hi Paddocks.

Im in the process of selling a property. The whole process started in January and the attorneys as well as the seller advised the registration will go through by end of March. Needless to say the documents haven’t even been sunmitted yet.

The buyer and seller signed an addendum stating that the buyer is responsible for all levies etc from 1 May.

The trustees made a decision on 21 April for special levies (R17 000), notice was sent out on 29 April and advised it was payable on 1 June.

1. Who is responsible for the payment in light of the addendum signed?

2. If the seller is responsible, do i have any recourse as i feel the attorneys then held up the transfer?

3. How can the seller be responsible to pay for new lifts, something that he gets no joy from?

Hi Renda,

Thanks for your question. If the trustee resolution, as required by Prescribed Management Rule 31(4B) in Annexure 8 the Regulations to the Sectional Titles Act 95 of 1986, was signed on 21 April 2016, the registered owner of the unit, at that time, is liable for the full special levy raised, irrespective of any agreement entered into between the seller and purchaser, which is not binding on the body corporate. Should you require further assistance with this matter please contact our private consulting department on consulting@paddocks.co.za for a no obligations quotation.

Thanks,

Paddocks

Hi Paddocks,

I am a home owner of a Sectional Title where there are 32units. The normal levy was R1550 at the time. Trustees decided to have a special levy to level the parking bays. The levies then went on to be R1900 per month for 4months. I had not budgeted for this extra amount and could not afford it at the time. But I paid this amount in the coming months anyway even though I was strained. In January eventually the extra R300 to R400 over the months had caught up with me and could not pay my levies for two months. I then received a demand letter from the lawyers asking me to pay the amount. I went to pay R3500 on the 7th of March 2016, R2500 in April and I had been paying more than the initial levy of R1550 so I could catch up on my payments.

I received a summons from the Managing Agent’s lawyers asking me to pay lawyer fees of close to R7000. My predicament is that the Trustees went on to impose these special levies to us without formally consulting the owners. This resulted in me being set back financially and unable to pay my levies for two consecutive months.

Is it legal for them to force me to pay legal fees?

Hi Karoline,

In terms of Prescribed Management Rule 31(4B) of Annexure 8 of the Sectional Titles Act 95 of 1986, the trustees, via a trustee resolution are authorised to raise special levies. There is no requirement to first consult with the owners in this regard. Should an owner fail to pay their levies and/or special levies and other charges, the trustees may hand these owners over for arrear levy collection in terms of Sections 37(2) and 37(2A) of the Act.

The legal costs incurred in this regard are recoverable by the relevant owner (you in this case) in terms of Prescribed Management Rule 31(5).

All the best,

Paddocks

How long can a special levy be effective? 2 to 3 years in succession? Or is there a cut off period?

Hi Vaughan,

Technically, a special levy cannot run past the next AGM.

We offer a Free Basics of Sectional Title short course starting soon, which can answer all your general sectional title related questions: http://www.paddocks.co.za/courses/free-basics-of-sectional-title/

Kind regards,

Paddocks

Hi Paddocks,

I own a unit in a complex at the coast and am renting it out as holiday property. The trustees have now decided to charge a fee per rental in order to employ a tenant controller. The aim of this is to improve security for all around the complex as he is controlling the entry into the complex. Are they allowed to only impose a fee ONLY to those units that rent out the property as everyone benefits from this? Are they allowed to charge exorbitant amounts for this which are obviously adding up to well above the salary of the person they are employing? I understand that they have the right to raise a special levy, but we mostly feel that this is not necessary, it is over charged and should be divided amongst all owners.

Hi Rene,

Thank you for your comment. We would love to help but unfortunately do not give free advice. Please see below for how we can help:

– We offer consulting via telephone for R390 for 10 minutes. Please call 0216863950.

– We have Paddocks Club, an exclusive online club, headed by Prof Graham Paddock, to help you get answers to your questions about community schemes: http://club.paddocks.co.za/

– We offer a Free Basics of Sectional Title short course starting soon: http://www.paddocks.co.za/courses/free-basics-of-sectional-title/

Kind regards,

Paddocks

I was advised by the previous owner of the amount of special levy which I agreed to prior to the purchase of my property however after I had paid the agreed amount the managing agent advised me of another amount which means I have to pay 10 000 rand more. Do I have any recourse in this respect as it almost 2 years later and I never received a statement stating the amount of the special levy by the managing agent to date.

Hi Arisha,

Thank you for your comment. We would love to help but unfortunately do not give free advice. Here’s how we can help:

– We offer a Free Basics of Sectional Title 1-week short course. You’ll be able to ask your course instructor any related questions. Find out more here.

– We offer consulting via telephone for R390 for 10 minutes. Please call us on +27 21 686 3950.

– We have Paddocks Club, an exclusive online club, to help you get answers to your questions about community schemes. Find out more here.

Kind regards

Paddocks

Hi Paddocks,

We currently rent premises & the landlord has passed on the special levy to us & expects us to pay for this. Is this right? or can we fight it?