Previously we published a list of all the resolutions that can be taken in a sectional title scheme. The list identified the type of resolution required for specific purposes and set out the level of consensus necessary to take each resolution. However, there can be specific conditions that apply in addition to the level of consensus required to take a special resolution for a particular purpose.

Special resolutions in sectional title schemes are required to authorise significant decisions by the body corporate. Most people know that taking a special resolution requires a higher level of consensus among the owners than ordinary resolutions. What they don’t know is that there are several conditions that must be met in taking the resolution, which if not taken, might result in the decision being invalid.

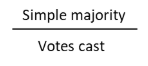

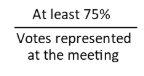

Ordinary resolutions are passed by a simple majority (counted in vote value) of the votes cast at a general meeting but the required percentage to pass a special resolution is 75%. Note that the percentage is not of the votes cast, as in taking an ordinary resolution, but of all the votes represented at the meeting. So, if one were to illustrate this point as mathematical fractions they would be:

Ordinary resolution =

Special resolution =

When taking a special resolution at a meeting, the votes are counted in two ways, in number as well as in vote value.

Special resolutions can be taken either at a meeting or by circulating a document containing the text of the resolution, commonly called a “round robin” resolution, for owner signatures. Only once 75% of all the owners, again counted in number as well as in vote value, have signed the resolution, is it passed. However, there are three circumstances under which the special resolution can only be taken at a meeting and not by round robin:

- If a special resolution is passed at a general meeting by members holding less than 50% of the total vote value, members together holding at least 25% of the vote value have a week to request another general meeting to reconsider the special resolution.

- The body corporate can terminate the managing agent’s contract on two months’ notice without liability or penalty but only by taking a special resolution at a meeting.

- The trustees can propose an improvement to common property that is reasonably necessary by sending a notice, with all the details, to the owners. If any member requests a meeting to discuss the proposed improvement to the common property, the improvement can only be approved by special resolution taken at a general meeting.

Meetings require notice and there are specific requirements for the notice of a meeting at which a special resolution is to be considered, namely:

- The notice must contain the agenda with the proposed wording of the special resolution.

- The notice must be delivered by pre-paid registered post to a physical or postal address in South Africa (it can alternatively be hand delivered to the member’s section if that is practical).

- The notice period must be at least 30 days but if the trustees consider the matter urgent, they can give shorter notice, as little as 7 days, but they must take a trustee resolution, giving their reasons, to authorise the short notice.

However, the trustees may not give short notice of a meeting at which the special resolution to be considered, is to authorise an improvement to the common property that is reasonably necessary. They may also not give short notice of the special resolution to authorise the installation of pre-paid meters by the body corporate on the common property. That resolution requires 60 days’ notice and occupiers as well as owners must be notified.

Finally, if either a member or the body corporate cannot obtain the special resolution, they can apply to the Community Schemes Ombud Service for relief.

Please contact consulting@paddocks.co.za if you have any difficulties with special resolutions and we can provide you with a no-obligation quote to assist you.

Article reference: Paddocks Press: Volume 14, Issue 06.

This article is published under the Creative Commons Attribution license.

Recent Posts

Recent Comments

- Graham Paddock on Body Corporate Functions: Insurance

- Graham Paddock on Spending body corporate funds

- Graham Paddock on The Levy Clearance Certificate: The Body Corporate’s Cheap & Effective Weapon

- Graham Paddock on The benefits of online sectional title meetings

- Heinz Wiesner on The benefits of online sectional title meetings

Archives

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- March 2009

- February 2009

- February 2008

- February 2007

1 Comment.

Can Trustees decide to charge another special levy which was not worded in the AGM Agenda apart from the special levy shown in the agenda and budget?