By Jennifer Paddock

Body corporate resolutions may seem like a simple topic but I can tell you from experience that it is often misunderstood. In Paddocks Club, our online coaching platform where we give community scheme advice to members, the issue of how to legally pass an ordinary, special or unanimous resolution comes up time and again.

“Does each body corporate member have one vote or do we need to count votes based on PQ – or both?!”

“We want to take an ordinary resolution in writing, will a simple majority suffice?”

“Is the quorum requirement raised for a meeting at which a special resolution is to be taken? Or is that just for unanimous resolutions?”

I’ll answer all of these questions and more in this article. But what I’m aiming to give you here is a ‘cheat sheet’ that summarises all of the basic requirements to legally take body corporate resolutions.

Types of resolutions

All body corporate decisions are taken by member resolution. A proposed resolution must be voted on and decided by ordinary, special or unanimous resolution, each of which have different requirements and consensus levels.

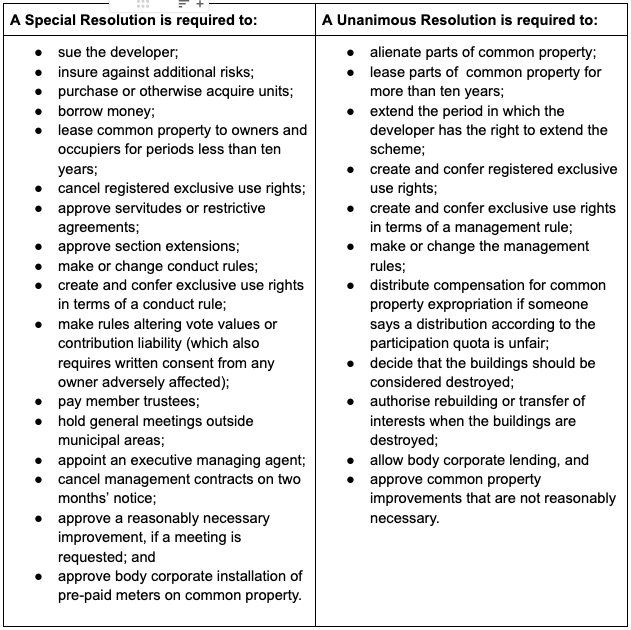

The Sectional Titles Schemes Management Act of 2011 (the ‘STSM Act’) and its prescribed rules require that some decisions be taken by special resolution, while others require a unanimous resolution. When neither the STSM Act nor the scheme’s rules require a special or a unanimous resolution, members take the decision by ordinary resolution.

Below are examples of decisions that the sectional title legislation specifically requires a special or unanimous resolution to authorise:

Two ways of taking resolutions

All types of resolutions can be taken either at a general meeting of the body corporate, or in writing, and there are different requirements for each method as summarised later below.

Calculating votes in ‘number’ and ‘value’

The legislation provides for two different ways of calculating votes and specifies when one or both of these must be taken into account for the purposes of passing a specific resolution.

In number: When votes are counted ‘in number’ each body corporate member is counted once irrespective of the number of units they own in the scheme. [s 6(7) STSM Act]

In value: When votes are counted ‘in value’ the default position is that the votes are calculated according to the participation quota (‘PQ’) attached to each section. So if one person owns four sections, the PQs of those four sections must be added together and the total will be the value of his/her vote.

However, if the developer or the body corporate has made a section 11(2) rule that varies the effect of the PQ for the purposes of calculating vote values, then the provisions of that rule apply instead of the PQ. [s 6(6) STSM Act]

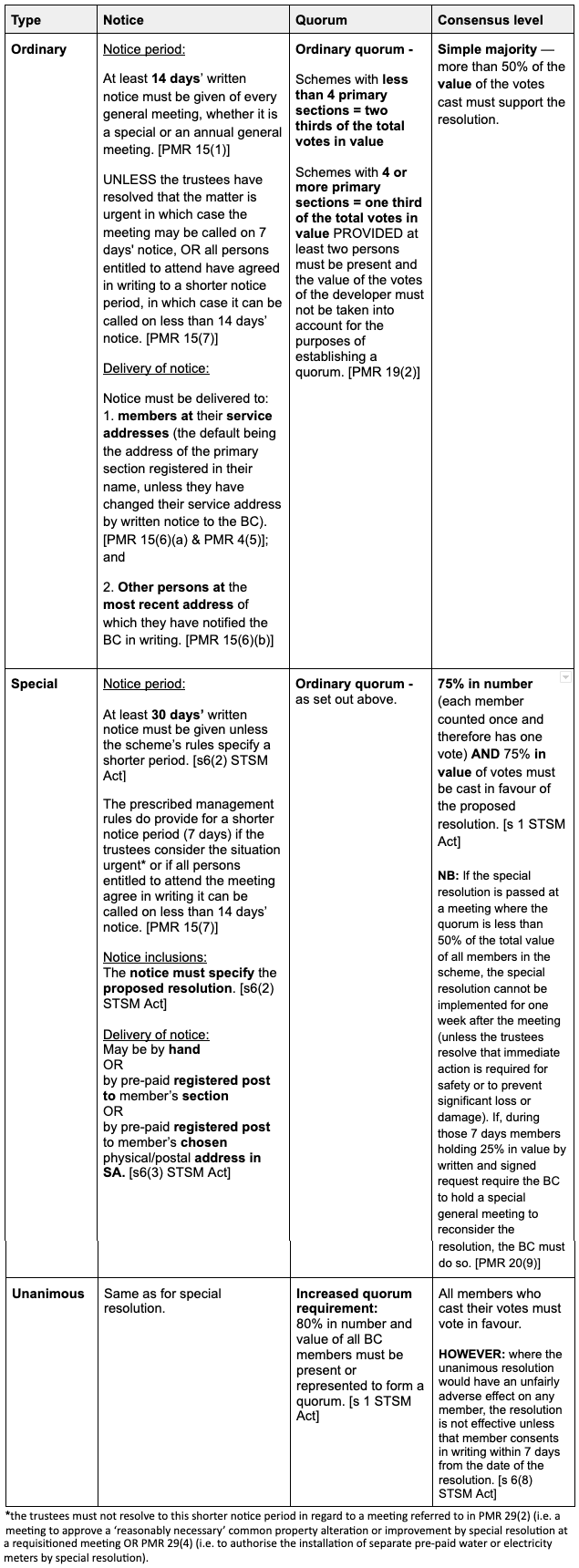

Resolutions taken at a general meeting of the body corporate:

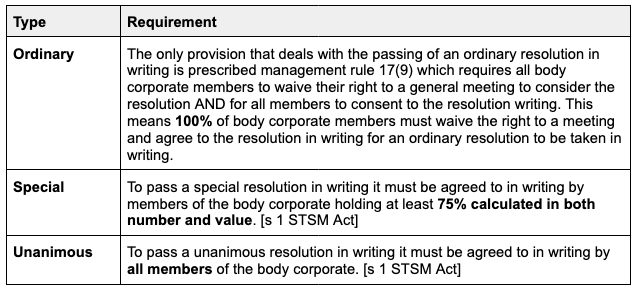

Resolutions taken in writing (aka by ‘round robin) by the body corporate:

Excluded Votes

A body corporate member is not entitled to vote for ordinary resolutions if:

- They refuse to pay to the body corporate any amount due by that member after a court or adjudicator has given a judgment or order for payment of that amount. [PMR 20(2)(a)] Note: a member is not disenfranchised simply because they are in arrears, it is only if legal action has successfully taken place and despite the adjudication order or judgment the member continues to refuse to pay. Or,

- A member persists in breach of any of the scheme’s conduct rules after a court or adjudicator has ordered that the member refrain from such breach. [PMR 20(2)(b)] Again, this disenfranchisement only applies if there is an adjudication order or judgment in place and the member continues in breach.

In addition, the value of the votes of any sections registered in the name of the body corporate must be considered abstentions. [PMR 20(3)]

So there you have it.

If you need help with questions relating to body corporate resolutions or any other questions relating to community schemes, consider joining us in Paddocks Club for fast support.

Article reference: Paddocks Press: Volume 17, Issue 11.

Jennifer Paddock is a dual-qualified lawyer with experience working as a strata title managing agent and solicitor in New South Wales. Prior to this, she served as a specialist sectional title attorney and practice manager at Paddocks for five and a half years. She brings a wealth of knowledge and expertise to the Paddocks team. Contact her at consulting@paddocks.co.za.

This article is published under the Creative Commons Attribution license.

Recent Posts

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- March 2009

- February 2009

- February 2008

- February 2007

Recent Comments