Previously, I wrote a blog post titled “Must the trustees send levy statements to owners in sectional title schemes?” which dealt with whether this is a requirement and if so, what needs to be included in the levy statement. With the adoption of the Sectional Titles Schemes Management Act 8 of 2011 (“the STSMA”) and the Community Schemes Ombud Service Act 9 of 2011 (“the CSOSA”) there have been some changes to this position.

Previously, I wrote a blog post titled “Must the trustees send levy statements to owners in sectional title schemes?” which dealt with whether this is a requirement and if so, what needs to be included in the levy statement. With the adoption of the Sectional Titles Schemes Management Act 8 of 2011 (“the STSMA”) and the Community Schemes Ombud Service Act 9 of 2011 (“the CSOSA”) there have been some changes to this position.

While the trustees (or managing agent) should still send monthly levy statements to each owner to ensure open and transparent governance, the items that should be included in the levy statement have changed. In my view, the levy statement should contain separate line items for each of the contributions that an owner may owe the body corporate.

The following constitutes a list of the possible contributions due by an owner to the body corporate that could be included in the levy statement:

1. Normal levies raised to fund the administrative fund

In terms of section 3(1)(a) of the STSMA a body corporate must establish and maintain an administrative fund, which is reasonably sufficient to cover the estimated annual operating costs for the repair, maintenance, and management of the common property (including reasonable provision for future maintenance and repairs); for the payment of rates and taxes and other local municipality charges for the supply of electricity, gas, water, fuel and sanitary or other services to the building or land; for the payment of any insurance premiums relating to the building or land; and for the discharge of any duty or fulfilment of any other obligation of the body corporate. In terms of section 3(1)(b) of the STSMA, a body corporate must require the owners, whenever necessary, to make contributions to such funds. The levies required to fund the administrative fund are raised at the annual general meeting (“AGM”), and are based on the approved budget. This is collected on the basis of each owner’s participation quota.

2. Levies that are raised to fund the reserve fund

The requirement to establish and maintain a reserve fund is in addition to the requirement to establish and maintain an administrative fund. In terms of section 3(1)(b) of the STSMA a body corporate must establish and maintain a reserve fund in such amounts as are reasonably sufficient to cover the cost of future maintenance and repair of common property, but not less than such amounts as may be prescribed. Regulation 2 of the Sectional Titles Schemes Management Regulations (the “STSMR”) sets out the prescribed minimum amounts for the reserve fund. these amounts are the minimum amounts, and may not accurately reflect what is required in your scheme. Therefore, it is important for each scheme to comply with Prescribed Management Rule (“PMR”) 22 of Annexure 1 of the STSMR, which provides that a body corporate must prepare a written maintenance, repair and replacement plan (“MR&R plan”) for the common property. In terms of section 3(1)(b) of the STSMA a body corporate must require the owners, whenever necessary, to make contributions to such funds. Prescribed Management Rule (“PMR”) 24(2) provides that the reserve fund must be used for the implementation of the written maintenance, repair and replacement plan (“MR&R plan”) of the body corporate. These levies are raised at the annual general meeting (“AGM”), based on the approved budget and MR&R Plan, and collected on the basis of each owner’s participation quota.

3. Special levies raised by the trustees

PMR 21(3)(a) gives the trustees the power, on the authority of a written trustee resolution, to levy members with a special levy if additional income is required to meet a necessary expense that cannot reasonably be delayed until provided for in the budget for the next financial year. These levies are therefore raised by the trustees for necessary and unbudgeted expenses as they arise.

4. Additional exclusive use contributions

In terms of section 3(1)(b) of the STSMA, a body corporate must require the owners of sections, (entitled to the right to the exclusive use of a part or parts of the common property, whether or not such right is registered or conferred by rules), to make such additional contribution to the funds as is estimated necessary to defray the costs of rates and taxes, insurance and maintenance in respect of any such part or parts, including the provision of electricity and water, unless in terms of the rules the owners concerned are responsible for such costs. These additional contributions are collected in terms of section 3(1)(c) of the STSMA, or in terms of the exclusive use rule.

5. The levy that needs to be paid to the Community Schemes Ombud Service

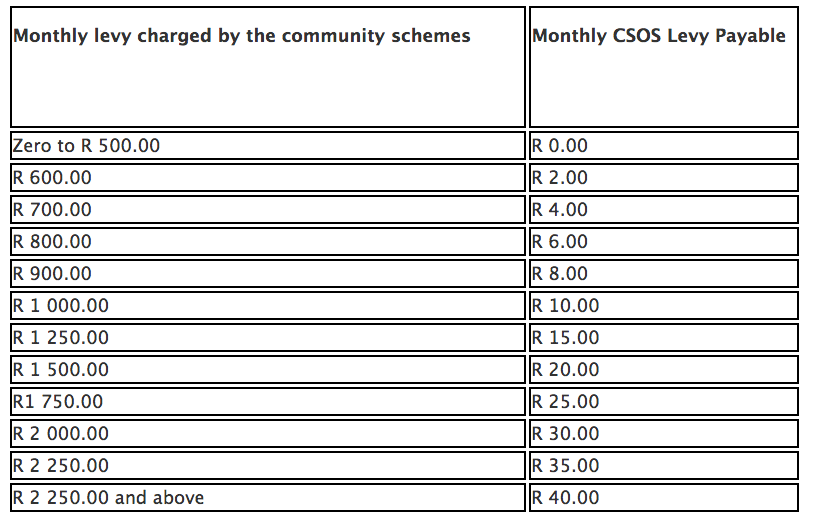

In terms of section 59 of the CSOSA every scheme must, each calendar year, at prescribed times, pay Community Schemes Ombud Service (“the CSOS”) a levy as prescribed (subject to discounts and waivers). Regulation 2 Community Schemes Ombud Service (“CSOSR”) states that schemes must collect a monthly levy from every unit. This levy is calculated based on the monthly levy charged by the scheme. The CSOS Fee Regulation 2 contains a table showing the levies payable. This levy is paid to the CSOS quarterly on or before 31 March 2017; 31 June 2017; 31 September 2017; and 31 December 2017.

6. A rental amount due to the body corporate for leasing part of the common property

In terms of section 3(1)(h) of the STSMA, the body corporate can, on the authority of a special resolution, let out portions of the common property to owners for periods that do not exceed 10 years. An example would include a parking bay.

The rental amount charged for letting that portion of the common property can be included on the levy statement.

7. Any penalties due in terms of a valid fining rule for contravention of the Acts or rules

It is important to note that the fine imposed can be set out in the levy statement, but may not be added to the contribution, which an owner is obliged to pay in terms of section 3(1)(a), (b) or (c) of the STSMA, and claimed by the trustees as part of the monthly installments payable by the owner. PMR 24(1) states that the purpose of the contributions to the administrative fund is to pay for the scheme’s operating expenses for maintaining the common property. PMR 24(2) provides that the reserve fund must be used for the implementation of the MR&R plan. Therefore, the duty to contribute to the administrative or reserve fund cannot include the duty to make payment of fines. Additional contributions collected in terms of section 3(1)(c) of the STSMA must be used for maintaining the exclusive use areas.

If you have any queries in this regard, please contact us at Paddocks at consulting@paddocks.co.za or call us on 021 686 3950.

Article reference: Paddocks Press: Volume 13, Issue 1, Page 01.

Dr Carryn Melissa Durham is one of the most highly qualified Sectional Title Attorneys in the country (BA, LLB, LLM and LLD), Carryn forms part of the Paddocks Private Consulting Division.

This article is published under the Creative Commons Attribution license.

Recent Posts

Recent Comments

- Graham Paddock on Body Corporate Functions: Insurance

- Graham Paddock on Spending body corporate funds

- Graham Paddock on The Levy Clearance Certificate: The Body Corporate’s Cheap & Effective Weapon

- Graham Paddock on The benefits of online sectional title meetings

- Heinz Wiesner on The benefits of online sectional title meetings

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- March 2009

- February 2009

- February 2008

- February 2007

15 Comments.

Good afternoon

Are you allowed to add the following on the levy statement or do you need to open a seperate statement for it:

– excess on insurance claims,

– Legal fees

Thanks

Hi Lindie,

Thanks for your question. We do not give free advice but here’s how we can help:

– We offer consulting via telephone for R390 for 10 minutes. Please call 0216863950.

– We have Paddocks Club, an exclusive online club, headed by Prof Graham Paddock, to help you get answers to your questions about community schemes: http://club.paddocks.co.za/

– We offer a Free Basics of Sectional Title short course starting soon: http://www.paddocks.co.za/courses/free-basics-of-sectional-title/

Kind regards,

Paddocks

Is the CSOS amount Vatable?

Hi Brigitte,

No it is not. For more information, we offer consulting via telephone for R390 for 10 minutes. Please call 0216863950.

Kind regards,

Paddocks

Hi

Just a quick question can a body corporate, without notification, just take the municipality account and divide amount the units, I feel this is unfair, example we are two in our unit, and we pay plus minus R900pm for water, yet there is another unit where there are 10 and they pay the same, where can i escalate this

Hi Verney,

Thank you for your comment. We would love to help but unfortunately do not give free advice. Please see below for how we can help:

– We offer consulting via telephone for R390 for 10 minutes. Please call 0216863950.

– We have Paddocks Club, an exclusive online club, headed by Prof Graham Paddock, to help you get answers to your questions about community schemes: http://club.paddocks.co.za/

– We offer a Free Basics of Sectional Title short course starting soon: http://www.paddocks.co.za/courses/free-basics-of-sectional-title/

Kind regards,

Paddocks

I suggest that this list should include monthly costs for separately metered services: e.g. cost of telephone calls (where the scheme’s telephone connections are via a p.a.b.x.) or water or electricity (where separate meters are provided in all sections).

Does the calculation of the CSOS levy include the reserve fund levy?

Hi Maria,

Thank you for your comment. We would love to help but unfortunately do not give free advice. Here’s how we can help:

– We offer a Free Basics of Sectional Title 1-week short course. You’ll be able to ask your course instructor any related questions. Find out more here.

– We offer consulting via telephone for R390 for 10 minutes. Please call us on +27 21 686 3950.

– We have Paddocks Club, an exclusive online club, to help you get answers to your questions about community schemes. Find out more here.

Kind regards

Paddocks

I was elected to serve on the Country Life Retirement Village finance committee and attended 2 meetings. At the third meeting the chairman advised us that the committee was being disbanded as he had heard that someone had disclosed the villages financial information to another village. No proof was disclosed to us.

What are our options. It would appear to me that some of the questions being asked by the finance committee are sensitive??

Hi Bob,

Thank you for your comment. We would love to help but unfortunately do not give free advice. Here’s how we can help:

– We offer a Free Basics of Home Owners Association 1-week short course. You’ll be able to ask your course instructor any related questions. Find out more here.

– We offer consulting via telephone for R490 for 10 minutes. Please call us on +27 21 686 3950.

– We have Paddocks Club, an exclusive online club, to help you get answers to your questions about community schemes. Find out more here.

Kind regards

Paddocks

Hi there

does the CSOS levy need to be itemised on a Levy statement or can it be included (lump summed) with the levy charge?

Hi Bronwyn,

Thank you for your comment.

This is something our attorneys would be able to assist with. Please email us on consulting@paddocks.co.za with regards to your matter, and we can provide you with a no-obligation quote, so that we can assist you.

Kind regards,

Paddocks

I’m engaged in a debate regarding the date that should appear on a levy invoice, account or statement. A while ago we received a directive that SARS insists on the same date of the levy month, also appearing as the date of the account. In other words, if the levy is for 1 March 2021, then the account should state the same date and not 24 Feb 2021 for instance, irrespective on when line items were captured on the account and utility meters were read. Are you perhaps able to shed some light on this?

No, unfortunately I cannot assist you with this issue. I suggest you talk to an accountant who has a working knowledge of sectional title billing.